Email marketing is a low-cost way community banks can connect with their customers. Not only will you be informing and engaging consumers, but you will also be humanizing your brand. And although some believe email marketing is dead due to the rise in social media and text messaging, this is false. Out of all marketing channels, email marketing has the highest ROI. In fact, for every $1 spent, email marketing generates $42 – that’s an astounding 4,200% ROI. So if your bank doesn’t have an email marketing strategy, it’s missing out on a huge opportunity to grow its brand and revenue. To help you get started, we’ll go over three easy ways community banks can use email marketing.

New Customer Onboarding

When the bank acquires a new customer, welcome emails are essential to making a good first impression. They’re so important that they provide three times the conversion rate (Links to an external site.) per email compared to regular promotional emails.

Here are some topics to cover in your customer onboarding email:

• Thank customers for choosing your bank

• Introduce other products

• Offer educational materials from your website

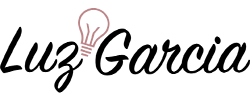

A great example of a customer onboarding email can be seen by Regions Bank. Here’s what their welcome email looks like for new customers.

Financial Education and Tips

Another easy and great way to use email marketing is to educate your customers. For many, sometimes, financial concepts can be difficult to understand. As a community bank, you should be a source of information for the community you serve. You should educate your customers on the services you provide and give them tips to help them on their financial journey.

By providing financial education and tips in your email marketing, your bank will:

• Be seen as an authority figure in the banking industry

• Build trust and confidence with your customers

• Increase customer loyalty

• Increase brand awareness

• Increase website traffic

• Sell more in the long term

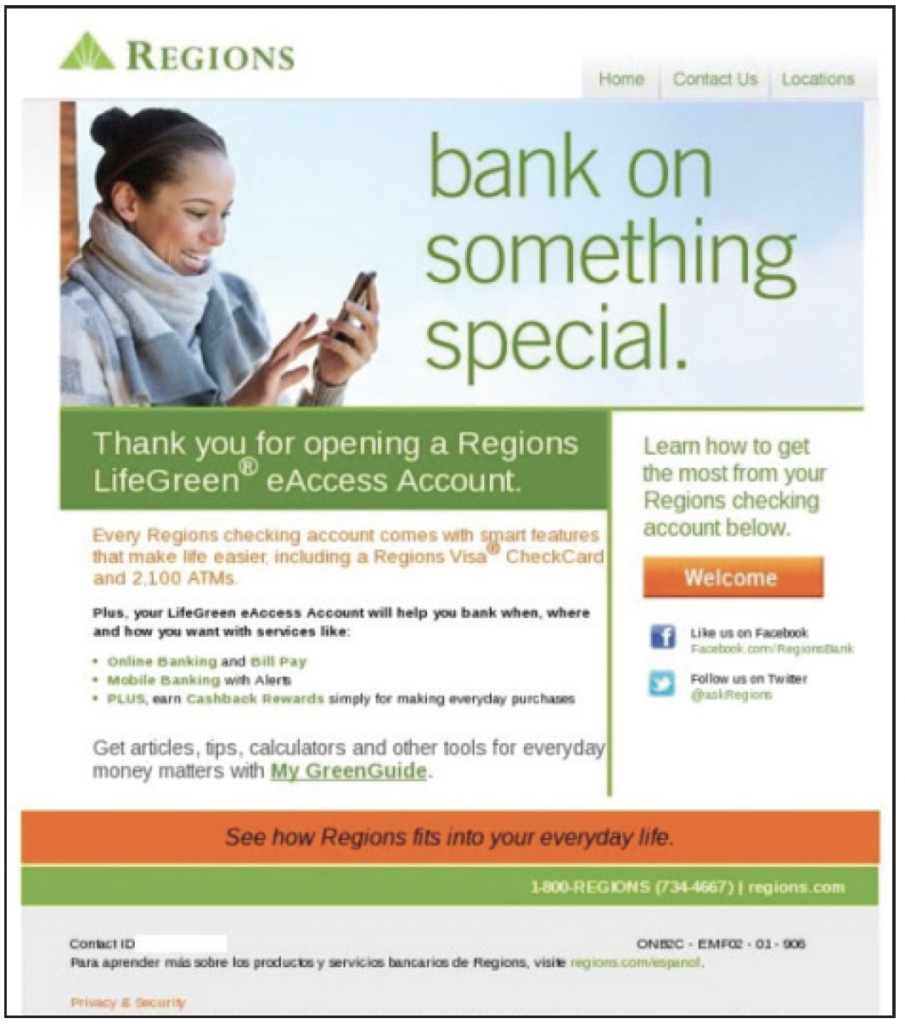

Here’s a snapshot of a great example by Marine Bank and Trust. Their monthly e- newsletter contains financial tips that lead back to their website and third-party articles.

Important Notifications

Out of all of the best practices for bank email marketing, sending important notifications is high on the list. Bank customers actually expect these types of emails since they usually require an action from the client. According to SendGrid, second to welcome emails, notification emails have the highest open-rate compared to any other email category. Not only are these emails extremely personalized, but consumers view them as important and helpful.

Some notification emails could include:

• Payment reminders

• Low balance notifications

• Suspicious activity

• Online banking and mobile banking updates

• Daily account summaries

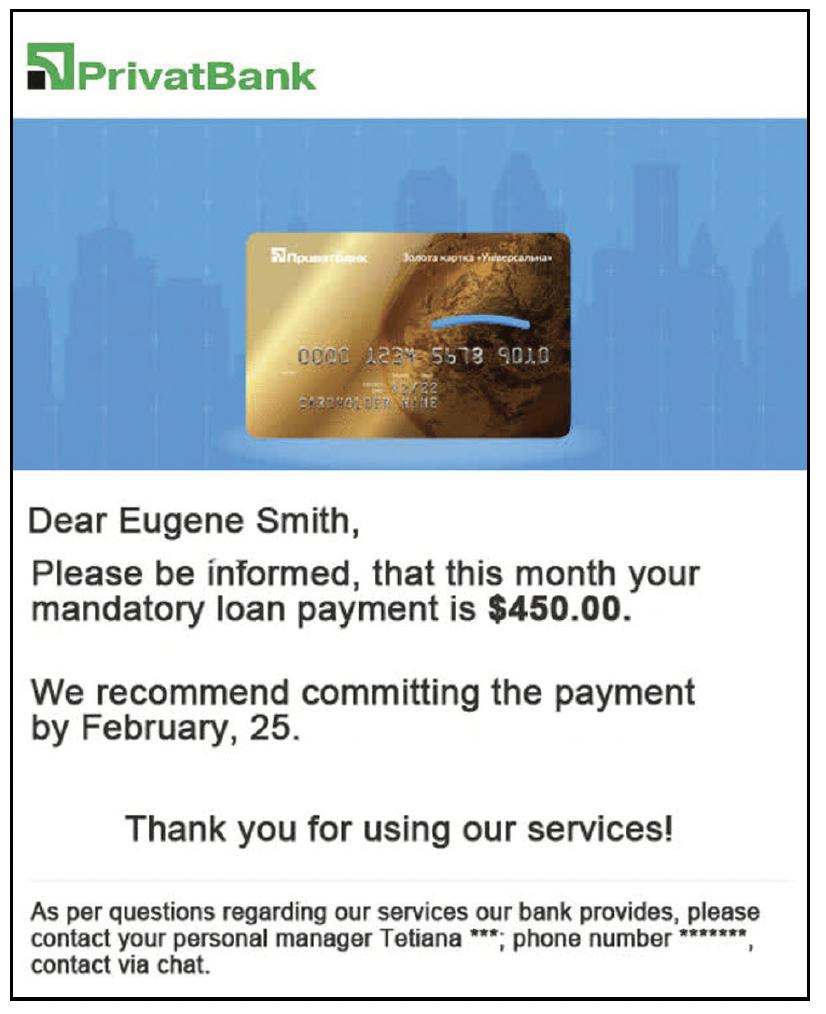

Here’s an excellent email notification example from PrivatBank for a loan payment. However, your email notification can be anything you like.

Please don’t be intimidated to include email in your marketing strategy. Your bank will build a relationship with your customers and be a helpful financial resource by sending the right content at the right time. If you have any questions, feel free to leave me a note at [email protected] and I’d be happy to give you some insights and tips to improve your email marketing strategy.